Do you care about getting paid for the goods or services you sell? Silly question, but many dollars are lost every day by companies with a lame invoicing system. It is not only possible but probable that some invoices are inaccurate, incomplete, or missed entirely. Scary thought, huh?

So, I ask: Could your invoicing system be broken? How do you know? Have you checked lately?

I once helped rescue a company that provides services for people with disabilities. The business had two-million dollars of annual revenue. We discovered the company was missing many invoicing opportunities—EVERY MONTH! There were some billing codes overlooked by untrained people in a half-baked business system. We made a few simple changes to the invoicing process, and the company has been raking in the EXTRA cash ever since.

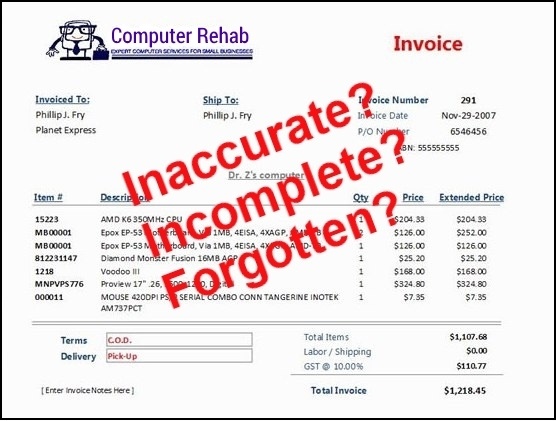

In another case, my computer sales and service vendor made mistakes on more than half the invoices I received from his company. I became conditioned to examine each invoice in great detail. Sadly, I couldn’t trust their work. Keep in mind that without a good system, this could happen to anyone, including YOU.

Effective business systems and processes are the only way to put important details within your control!

Six Tips for Improvement

For companies with varied and/or complex sales transactions, inaccurate invoices can leak a lot of profit over the course of a year. And what’s worse, you may never detect it!

Here are six tips to keep you from losing some of your hard-earned money.

- Review your sales invoicing procedure and identify ways money could slip through the cracks. Modify your procedure to plug the holes and create a bullet-proof system.

- Require customers to provide a detailed purchase order—with prices if possible—that you can compare with your outgoing invoice. Contact the customer if there are any discrepancies.

- Be on guard for pricing mistakes or incomplete invoices. Look for legitimate billing opportunities that could be missed by your company.

- Consider adding a second approval for sales invoices over a specified dollar amount. Employees typically aren’t too concerned about invoicing issues; it’s not their money. So YOU or a supervisor needs to touch the invoicing system when bigger dollars are at stake.

- Perform an occasional spot check or audit of customer invoices for a particular time period. This helps keep people on their toes. Use the information you find to improve the system, not to scold people. If invoices are carelessly prepared, well, that’s a people problem you need to address.

- Collect money upfront whenever possible. If you offer terms, create a strong collections system to get paid promptly when money is due. Big Tip: Receiving cash payments at the point of sale will have a significant positive impact on invoice accuracy and efficiency, cash flow, and ultimately your profit margin!

Create a Near-Perfect Invoicing System

This will not surprise you: if an invoice error is in favor of your customer, they usually just assume the dollar amount was adjusted down for some legitimate reason they don’t have time to inquire about. If the invoice amount is higher than your customer expects, you will definitely get a phone call. In the end, a mistake-prone invoicing system will rob you of hard-earned dollars, create an unnecessary cost to research and rework errors, and diminish your customer’s confidence.

The invoicing system is one area of your business that should be near perfect (Six Sigma)!

Consider this fact: if your company makes an 8% net profit, you’ve spent 92% of the invoice amount filling the order. At that rate, it would require the net-profit from about thirteen orders to pay back the lost dollars of one missed invoice. YIKES! (see “Sales Equivalency—The Surprising Power of Cutting Costs!”)

Now, go make sure your customer invoicing system is asking for all the money you deserve!