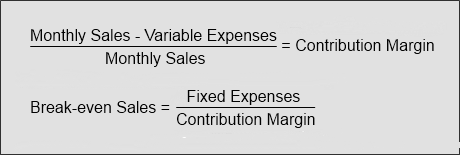

Calculating a business break-even point is not difficult. However, there are a few things you need to know in order to make it as accurate as possible.

As a review, your monthly break-even point is reached when your gross sales revenue equals your total fixed and variable costs; it is the point that your business begins to make a profit. (Please read “Do You Know Your Sales Break-even Point?” for more about this principle.)

Get Your Profit and Loss Statement

To begin, you need a copy of your “Profit and Loss Financial Statement.” If possible, get a printout that shows year-to-date information and the percent of sales for each line item. Divide the year-to-date total for each item by the number of months to get the average monthly expense (e.g., If your power bill through June is $2742, your average monthly power bill is $457). Averaging multiple months will minimize the effect of any unusual expenses in a single month.

Don’t forget to include the monthly portion of line items paid on a quarterly or annual basis such as payroll taxes or insurance. For example, if your annual insurance charge is $9,000, use 1/12 of that amount, or $750, as part of your monthly budget for calculating the break-even point.

Categorize Costs

Looking at individual line items, you will first decide which costs are fixed, which are variable, and which are a mixture of both. Let’s discuss each possibility.

- Fixed Costs – These expenses are dollars paid or accrued each month, even if you don’t make a single sale. They include such things as rent, insurance, utilities, equipment leases, contracts, accounting fees, and so forth. Fixed costs are sometimes referred to as overhead or administrative costs.

- Variable Costs – These expenses are directly related to the products or service you deliver. They include line items such as materials, supplies, labor, and shipping expenses. Variable costs are generally referred to as cost of goods or cost of sales, and are best represented as a percent of sales. For example, the cost of materials and labor might be 50% of the sales price.

- Mixed or Semi-Variable Costs – These costs are part fixed and part variable. If they are not broken out separately on your Profit and Loss Statement, you will have to estimate them for your break-even analysis.

For example, some of your wages may be administrative (fixed), while other wages are related to the products made or services performed (variable).

Your utilities, such as lights and heating are fixed; however, power to run equipment for manufacturing a product is a variable cost. The amount varies according to production demands.

If you have a marketing budget that is a percent of sales, this would also be a variable cost—the more you sell, the more you can spend on advertising. If you have a minimum monthly advertising expenditure or set media contracts such as radio, television or newspaper, these costs are fixed; you pay them every month, even if they don’t generate any sales.

In a final example, let’s say you hire a new sales person and want to use a break-even analysis to discover how much more you need to sell in order to cover his or her cost. If the sales person is paid a salary, the cost is fixed, if paid a commission, the cost is variable. Paying a salary plus commission or bonus would be a mixed cost.

I think you get the idea. Keep in mind that costs change and expenses tend to creep up. Recheck the numbers periodically. Caution: the break-even point is dramatically affected by hiring new people without a corresponding increase in sales.

Calculate Your Break-even Point

The formula for computing your business break-even point is described below. Don’t worry if it doesn’t quite make sense. I have provided a spreadsheet tool so you can just plug in the numbers. Remember to use amounts for the average month.

Lower Your Break-even Point

As mentioned in my previous article, there are four ways to reach your break-even point earlier in the month and begin making a profit sooner.

- Lower your overhead (fixed costs) – Keep fixed costs to a minimum and resist the temptation to increase them, unless absolutely necessary. It’s very hard to go back if sales drop. However, don’t cut costs too deeply, especially if there is a negative effect on customers or employees.

- Lower the cost of each product or service sold (variable costs) – By lowering direct costs, your gross margin will increase. Be diligent about purchasing material at the most favorable price, controlling inventory, or improving the productivity of your workforce.

- Increase your prices (and gross margin) – Most business owners are reluctant to raise prices because they think sales will decline. More often than not, that doesn’t happen, unless you are in a very price-sensitive market. Raising prices only a few percent will have a significant effect on your break-even point. There is a delicate balance between sales volume and pricing, so be cautious about changes, and test if you can.

- Increase your sales – The toughest job of most small-business owners is to increase sales. A business owner nowadays must be an outstanding marketer, or able to hire one. Never stop trying to improve marketing and sales strategies. Keep the pipeline full. Push every order you possibly can out the door by the end of the month, and then do it again next month. You make all your profit on those last few sales. And remember, a bad month can wipe out the profit of several good months.

As a Systems Thinker, your first thought is, “What business process do I need to improve to reach my financial break-even point sooner in the month? How can I make my administrative systems—hiring, accounting, computer support, custodial—less costly? Can I improve my purchasing system to buy materials or supplies for less? Can I reduce labor costs without affecting customer service? Could I change my pricing system or terms to squeeze out a little more profit? Can I improve my lead-generation or sales-conversion processes to close more sales?

You might be surprised by how many opportunities there are to cut overhead costs or create more margin from the sale your products or services. Those opportunities are just waiting to be discovered as you work on your business in The Zone.

Motivate Your Employees

By the way, if you work within tight profit margin, it is a good idea to let employees know your break-even point. This gives them a clear picture of expenses and what it actually takes to run the business. It also motivates that little extra oomph at the end of the month to get orders done and out the door.

Many companies fail because owners do not know this single number—the sales break-even point. DON’T LET THAT HAPPEN TO YOU!

Related Articles:

Do You Know Your Sales Break-even Point?

Access a Spreadsheet for Doing a Break-Even Analysis