Get a quick start on your Paycheck Protection Program loan

The path to U.S. federal funding begins with QuickBooks.

Keep more of what

you earn

QuickBooks Self-Employed helps automate tax prep all year and uncover deductions you didn't know about.

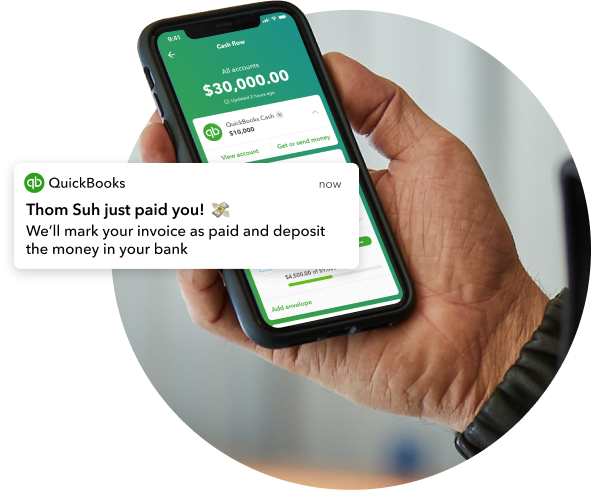

Money in.

Money organized.

When you’re paid, QuickBooks automatically organizes it so your books are balanced at tax time and year round.

Payments made easy

Online or on-site, card or eCheck. Always have just the way to let customers pay, no matter how or where you work.

Live Bookkeeping

Manage expenses

for freelancers

Accounting for

business

Payroll

Payments

Find smart, simple tools that help your whole business thrive

Organization and tax time made easy

with

with

Full-Service Bookkeeping

Run your business with confidence and leave your bookkeeping to the pros. Work with a Live Bookkeeper who can manage and maintain your books with guaranteed accuracy. Schedule a call with one of our specialists for pricing details that fit your business.

Your bookkeeper will:

- Bring your books up to date

- Set up QuickBooks for you

- Categorize transactions

- Reconcile accounts

- Close the books each month

- Run detailed reports

QuickBooks Online Payroll plans

Get your payments matched with invoices for effortless bookkeeping

Payments requires a QuickBooks Online plan and needs to be activated in QuickBooks.

- Send and track simple invoices

- Separate business & personal expenses

- Help maximize Schedule C deductions

- Quarterly estimated taxes calculated automatically

- Automatic mileage tracking

Included features:

- Send and track simple invoices

- Separate business & personal expenses

- Help maximize Schedule C deductions

- Quarterly estimated taxes calculated automatically

- Automatic mileage tracking

- Pay quarterly estimated taxes online directly from QuickBooks

- Easily transfer info to TurboTax

- One state and one federal tax return filing included in this bundle

Included features:

- Send and track simple invoices

- Separate business & personal expenses

- Help maximize Schedule C deductions

- Quarterly estimated taxes calculated automatically

- Automatic mileage tracking

- Pay quarterly estimated taxes online directly from QuickBooks

- Easily transfer info to TurboTax

- One state and one federal tax return filing included in this bundle

- Talk to real CPAs when you need

- Get unlimited help and advice all year

- Have a CPA do a final review of your return

Included features:

Track mileage automatically

Use your smartphone to reliably and efficiently track the miles you drive for work and increase deductions on your taxes. Best of all, it won’t drain your phone’s battery.

Easily sort and track expenses

Keep tabs on your finances right from your smartphone. Import expenses directly from your bank or other business account, sort business from personal spending with a swipe, and save time on taxes.

Snap and store receipts

Snap a photo of your receipt, or forward it directly from your email. We’ll match and categorize expenses automatically. Receipts are stored, organized, and ready for tax time.

These days with very user friendly options, it has made it much more approachable. I would say anybody can do it.

Jasmine Beck, Sunshine Alchemy

- Track income & expenses

- Capture & organize receipts

- Maximize tax deductions

- Invoice & accept payments

- Track miles

- Manage cash flow

- Run general reports

- Send estimates

- Track sales & sales tax

- Manage 1099 contractors

- Manage & pay bills

- Track time

- Multiple users (up to 3)

Included features:

Upgrade to Essentials get:

- Track income & expenses

- Invoice & accept payments

- Maximize tax deductions

- Run enhanced reports

- Capture & organize receipts

- Track miles

- Track sales & sales tax

- Send estimates

- Manage 1099 contractors

- Includes 3 users

- Manage & pay bills

- Track time

- Track project profitability

- Track inventory

Included features:

Upgrade to Plus get:

- Track income & expenses

- Capture & organize receipts

- Maximize tax deductions

- Invoice & accept payments

- Track miles

- Manage cash flow

- Run comprehensive reports

- Send estimates

- Track sales & sales tax

- Manage 1099 contractors

- Includes 5 users

- Manage & pay bills

- Track time

- Includes 5 users

- Track project profitability

- Track inventory

- Business analytics & insights

- Batch invoices & expenses

- Automate workflows

- Customize access by role

- Dedicated account team

- On-demand online training

- Restore company data

Included features:

Upgrade to Advanced get:

- Track income & expenses

- Capture & organize receipts

- Maximize tax deductions

- Invoice & accept payments

- Track miles

- Manage cash flow

- Run most powerful reports

- Send estimates

- Track sales & sales tax

- Manage 1099 contractors

- Manage & pay bills

- Track time

- Includes 25 users

- Track project profitability

- Track inventory

- Business analytics & insights

- Batch invoices & expenses

- Customize access by role

- Dedicated account team

- On-demand online training

- Restore company data

- Automate workflows

Included features:

Manage it all from one place

From tracking everyday expenses to being ready for tax time, QuickBooks can help you run your business smarter from anywhere you’re working.

Get invoices paid anywhere, anyhow

Send invoices with a Pay Now button, and accept credit cards, debit cards, and ACH bank transfer payments on the go, on any device.

Plan, save, and bank seamlessly

View all your money in and out so you can plan for the future. With a built-in 1.00% APY bank account, you can easily access and grow your money at the same time.**

You’re in good company

An important part of QuickBooks has been the ability to invoice customers---to have them click on a link to pay.

Craig Rogers, co-owner of Moto Guild

Payroll software that fits your business

With integrated time tracking and the ability to run payroll on the go—QuickBooks works with your schedule and your needs.** Best of all, you can run payroll in less than 5 minutes with QuickBooks Online Payroll.7

Payroll with perks

We’ll automatically calculate, file, and pay your payroll taxes once setup is complete.** With tax penalty protection, we'll also pay up to $25,000 if you receive a payroll tax penalty no matter who made the mistake.

Keep all your business tools together

Manage payroll and your books all in one place with the integrated suite of QuickBooks products. Payroll and accounting data syncs and updates automatically to save you time.

Accounting is not my forte. QuickBooks helps me see my finances visually with graphs and things.

Libby Hockenberry and Cary Smith, The Victorian

Make invoices instantly payable

Add a button to your invoices to let customers pay online. Get paid 2x faster than you would with paper invoicing.1

Deposits that work as fast as you

Have money on hand when you need it. Eligible payments are deposited next business day—or instantly for an extra 1%.**

Bookkeeping without the busywork

No matter how customers pay, we’ll record and match every payment for you. Your books stay effortlessly organized for tax time all year, all in one place.

The proof is in the prosperity

An important part of QuickBooks has been the ability to invoice customers---to have them click on a link to pay.

Craig Rogers, co-owner of Moto Guild

Your books done right. Guaranteed.

Have confidence knowing your bookkeeper reviews and closes your books each month—so you can focus more time on running your business.

Ongoing assistance from your bookkeeper

Whenever you need an extra hand, count on a QuickBooks-certified bookkeeper to categorize and reconcile transactions and provide insights on your business.

Peace of mind that you’re up to date

Your books will be reviewed and closed every month by an expert you trust. When it’s time to file taxes, we’ll put together an up-to-date year end report for your business.

Works with the apps you already use

Connect seamlessly with your current apps to keep your

business running smoothly.

- I sell products

- I make $100k-1m

- I spend $25-50k

- Get ready for tax time

- Keep track of inventory

All plans include

Receipt capture

Snap photos of your receipts and we’ll automatically match them to existing expenses.

QuickBooks support

A member of our support team is ready and available to answer your QuickBooks questions.4

App integration

Use the apps you know and love to keep your business running smoothly.

Frequently Asked Questions

Is QuickBooks online, or do I download software?

Can I upgrade between plans?

There’s no contract, correct?

Do I have to pay extra for Intuit mobile apps?

Is it easy to get started?

What’s included in Full-Service Bookkeeping?

What’s not included in Full-Service Bookkeeping?

How is my team of bookkeepers organized?

What qualifications do my bookkeepers have?

How often can I connect with my QuickBooks Live bookkeeper?

Manage cash flow

Plan, save, and bank—all in one place

- Open a QuickBooks Cash account for business banking right inside QuickBooks.*QuickBooks Cash account: Banking services provided by and the QuickBooks Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to license from Visa U.S.A. Inc. Green Dot Bank operates under the following registered trade names: GoBank, Green Dot Bank and Bonneville Bank. Registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage. Account funds are FDIC-insured up to the allowable limits upon verification of Cardholder’s identity. Visa is a registered trademark of Visa International Service Association. Green Dot is a registered trademark of Green Dot Corporation. ©2020 Green Dot Corporation. All rights reserved. QuickBooks products and services, including Instant Deposit, QuickBooks Payments, Cash flow planning/forecasting are not provided by Green Dot Bank.

- Get paid online or in-person—deposited instantly at no extra cost, if eligible.*Free Instant Deposit: Includes use of Instant Deposit without the additional cost. Instant deposit is an additional service offered by QuickBooks Payments subject to eligibility criteria. Standard rates apply for ACH, swiped, invoiced, and keyed card transactions. Deposits are sent to the bank account linked to your QuickBooks Debit Card or another eligible debit card in up to 30 minutes. Deposit times may vary for third party delays.

- Earn 1% APY interest, and save for goals and expenses with digital Envelopes.*Annual percentage yield: The annual percentage yield ("APY") is accurate as of 9/28/20 and may change at our discretion at any time. The APY is applied to deposit balances within your primary QuickBooks Cash account and each individual Envelope. We use the average daily balance method to calculate interest on your account. See Deposit Account Agreement for terms and conditions.

Envelopes: You can create up to 10 Envelopes. Money in Envelopes must be moved to the available balance in your primary deposit account before it can be used. Envelopes earn interest as well. Each Envelope will automatically earn interest once created, which will be separately tracked from the primary account and any other Envelope. The interest will be applied to deposit balances in each individual Envelope at the end of your Billing Cycle. See Deposit Account Agreement for terms and conditions.

QuickBooks Payments and QuickBooks Cash accounts: Users must apply for both QuickBooks Payments and QuickBooks Cash accounts. QuickBooks Payments' Merchant Agreement and QuickBooks Cash account’s Deposit Account Agreement apply. - Forecast cash flow 30 and 90 days out to plan ahead and stay ahead.

A bank account reimagined for small businesses - 1:43

Automatic mileage tracking

Make every mile count

- Reliably and automatically track miles with your smartphone’s GPS

- Categorize business and personal trips with a swipe and add trips manually

- Get shareable reports that break down miles driven and potential deductions

QuickBooks - Automatic Mileage Tracking Tutorial - 0:30

Keep money in your pocket until payday

- Pay employees faster, for free

- Submit payroll up to 7AM (PT) the morning of payday

- No additional charge for same-day service

Pay quarterly estimates online

Pay what you need, when you need to

- Avoid late fees with automatic reminders of quarterly tax due dates

- Accurate estimates help make sure you'll have enough money when you need it

- We do the math so you can avoid year-end surprises

File with confidence

Tax relief when you need it most

- File faster by exporting your Schedule C directly to TurboTax

- One federal and one state tax return filing included

- E-file your returns with direct deposit for the fastest tax refund

Tax advice on tap

CPAs review your return

Guaranteed done right

- TurboTax Live CPAs and EAs provide personalized answers to your tax questions—on demand

- Unlimited access to tax experts with 15 years experience

- Your CPA or EA review your return line by line, sign it, and guarantee it’s done right

Unlimited help and advice all year

We’ll do what it takes to get you the best outcome possible

- Get year-round tax advice that’s fine-tuned to your situation

- Simply click to connect to a real tax expert when you need them

- Enjoy the peace of mind and confidence that comes from having CPAs or EAs help you every step of the way

Final review help

Get a final review of your tax return

- Our CPAs and EAs can review your return line by line, sign it, and guarantee it for 100% confidence

- They’ll do what it takes to get you the best outcome possible

- Get live advice right on your screen

Track income & expenses

Know where your money is going

- Securely import transactions from your bank, credit cards, Square, and more*

- Automatically sort transactions into tax categories

- Snap photos of your receipts and we’ll automatically match them to existing expenses

- Create custom tags and organize them into unlimited tag groups to see where you make and spend money NEW

Track income and expenses in QuickBooks - 2:22

Separate business and personal expenses

Know where your money is going

- Securely import transactions from your bank, credit cards, Square, and more*

- Automatically sort transactions into tax categories

- Snap photos of your receipts and link them to expenses right from your phone

Track income & expenses

Know where your money is going

- Securely import transactions from your bank, credit cards, Square, and more*

- Automatically sort transactions into tax categories

- Snap photos of your receipts and we’ll automatically match them to existing expenses

- Create custom tags and organize them into up to 40 tag groups to see where you make and spend money NEW

Track income and expenses in QuickBooks - 2:22

Separate business and personal expenses

Know where your money is going

- Securely import transactions from your bank, credit cards, Square, and more*

- Automatically sort transactions into tax categories

- Snap photos of your receipts and link them to expenses right from your phone

Maximize tax deductions

Help avoid tax-time surprises

- Share your books with your accountant or export important documents come tax time

- Easily organize income and expenses into tax categories

- Automatically sort business expenses into the right tax categories to keep more of what you earn

Get organized and maximize deductions - 0:36

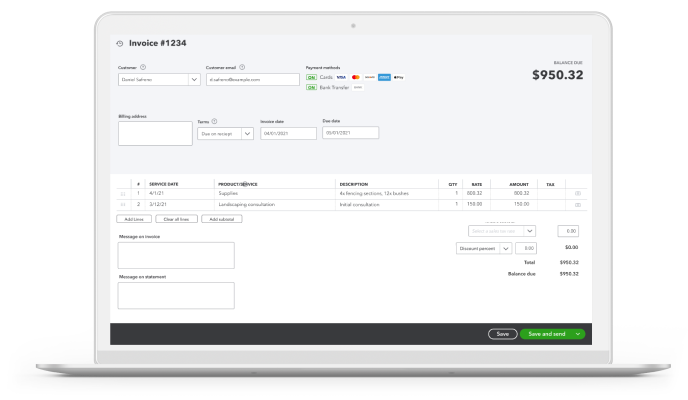

Invoice & accept payments

Look professional and get paid fast

- Accept all credit cards and bank transfers, right in the invoice

- Track invoice status, send payment reminders, and match payments to invoices, automatically

- Create professional custom invoices with your logo that you can send from any device

Create an invoice in QuickBooks - 2:37

Send invoices on the go

Look professional and get paid fast

- Effortlessly invoice customers from your smartphone

- Create partial invoices for stages of a project, track invoice status, and send payment reminders

- Get paid faster by accepting credit cards and bank transfers, right in the invoice

Invoice & accept payments

Look professional and get paid fast

- Effortlessly invoice customers from your smartphone

- Keep tabs on open invoices and send overdue notifications

- Get paid faster by enabling online payments

Create an invoice in QuickBooks - 2:37

Send invoices on the go

Look professional and get paid fast

- Effortlessly invoice customers from your smartphone

- Create partial invoices for stages of a project, track invoice status, and send payment reminders

- Get paid faster by accepting credit cards and bank transfers, right in the invoice

Run reports

Better decisions with valuable insights.

- Run and export reports including profit & loss, expenses, and balance sheets*

- Create custom tags and run reports to see where you make and spend moneyNEW

- Avoid surprises by easily tracking cash flow and reporting on your dashboard

Customize reports in QuickBooks - 3:17

Help maximize your Schedule C deductions

Better decisions with valuable insights.

- Run and export reports including profit & loss, tax summaries, and tax details

- Easily access mileage and transaction logs

- Avoid surprises by tracking cash flow and reporting on your dashboard

Send estimates

Get hired with professional estimates.

- Customize estimates to fit your brand and business needs

- Accept mobile signatures and instantly see estimate status

- Convert estimates into invoices with ease

Send estimates in QuickBooks - 2:37

Track sales & sales tax

Keep sales in sync no matter how you get paid

- Accept credit cards anywhere with our mobile card reader or sync with popular apps

- Connect to the e-commerce tools you love including Shopify*

- Automatically calculate taxes on your invoices

Easily record sales tax payments - 0:58

Manage & pay bills

Pay bills on time, every time

- Organize bills in one place, plus schedule and make payments right in QuickBooks.

- Pay online for free via bank transfer or debit card, or defer payments via credit card (2.9% fee).

- Choose how you want vendors to get paid, by check or contact-free direct deposit.

Manage your bills QuickBooks - 3:38

Multiple users

Save time when you work together

- Invite your accountant to access your books for seamless collaboration

- Give employees specific access to features and reduce errors with auto-syncing

- Protect sensitive data with user-access levels and share reports without sharing a log-in

Adding users in QuickBooks - 1:22

Track time

Clock employee time and billable hours

- Track billable hours by client or employee and automatically add them to invoices

- Enter hours yourself or give employees protected access to enter their own time

- Easily upgrade to QuickBooks Time for advanced time tracking features*

Time tracking in QuickBooks - 1:07

Track inventory

Stay stocked for success

- Track products, cost of goods, and receive notifications when inventory is low

- See what's popular, create purchase orders, and manage vendors

- Import from Excel or sync with Amazon, Shopify, Etsy, and more*

Track inventory in QuickBooks - 2:40

Manage 1099 contractors

Stay compliant on all your 1099s

- Assign vendor payments to 1099 categories

- See who you've paid, what you've paid, and when

- Prepare and file 1099s right from QuickBooks*

Prepare 1099s in QuickBooks - 3:33

Estimate quarterly taxes

Help avoid tax-time surprises

- Know what you owe each quarter before taxes are due

- Avoid late fees with automatic reminders of quarterly tax due dates

- Easily organize income & expenses for instant tax filing

Get organized and maximize deductions - 0:36

Quarterly estimated taxes calculated automatically

Help avoid tax time surprises.

- Know what you owe each quarter before taxes are due

- Avoid late fees with automatic reminders of quarterly tax due dates

- Easily organize income & expenses for instant tax filing

Get organized and maximize deductions - 0:36

Track project profitability

Manage work your way

- Get a bird's eye view of all your projects, all in one place

- Easily track labor costs, payroll, and expenses with job costing

- See project profitability in a glance with clear dashboards and reports

Projects with Job Costing in Quickbooks Online - 1:21

Capture & organize receipts

Ditch the shoebox and save with a snap

- Snap photos to add receipts on the go. Upload or email receipts to QuickBooks in seconds.

- We'll match your receipts to existing expenses or create new expenses for you.

- QuickBooks sorts your receipts into tax categories so you feel confident come tax time.

Run general reports

Better decisions with valuable insights

- Run and export reports including profit & loss, expenses, and balance sheets*

- Create custom tags and run reports to see where you make and spend moneyNEW

- Avoid surprises by easily tracking cash flow and reporting on your dashboard

Customize reports in QuickBooks - 3:17

Run basic reports

Better decisions with valuable insights

- Run and export reports including profit & loss, expenses, and balance sheets*

- Create customized reports to get important insights specific to your business

- Avoid surprises by easily tracking cash flow and reporting on your dashboard

Run enhanced reports

Better decisions with valuable insights

- Know how your business is doing with sales, accounts receivable, and accounts payable reports*

- Create custom tags and run reports to see where you make and spend moneyNEW

- Avoid surprises by easily tracking cash flow and reporting on your dashboard.

Customize reports in QuickBooks - 3:17

Run basic reports

Better decisions with valuable insights

- Run and export reports including profit & loss, expenses, and balance sheets*

- Create customized reports to get important insights specific to your business

- Avoid surprises by easily tracking cash flow and reporting on your dashboard

Run comprehensive reports

Deeper business insights

- Stay on track with inventory reports, enhanced sales reports, and profitability reports*

- Create custom tags and run reports to see where you make and spend moneyNEW

- Run specific budgeting, expense, and class reports*

- Choose from various templates and customize reports based on your business needs

Run basic reports

Better decisions with valuable insights

- Run and export reports including profit & loss, expenses, and balance sheets*

- Create customized reports to get important insights specific to your business

- Avoid surprises by easily tracking cash flow and reporting on your dashboard

Run most powerful reports

Most customizable reporting

- Monitor critical financial metrics like revenue and cash flow at a glance

- Build customized dashboards that measure performance against time period, budget, a specified number, and more

- Drill down into the transaction-level details key stakeholders want to know, including finance, sales, accounting, owners, and investors

- Create custom tags and run reports to see where you make and spend moneyNEW

Run basic reports

Better decisions with valuable insights

- Run and export reports including profit & loss, expenses, and balance sheets*

- Create customized reports to get important insights specific to your business

- Avoid surprises by easily tracking cash flow and reporting on your dashboard

Business analytics & insights

Get actionable insights with smart reporting by

— worth $468/year

- Track financial & non-financial KPIs to see how well your business is performing with in-depth analysis tools

- Create presentation-ready & customisable reports with easy-to-read visuals

- Compare, rank and benchmark your companies, clients or franchisees

Smart Reporting by Fathom™ - 1:31

Batch invoices & expenses

Put transactions in the fast lane

- Create invoices 37% faster with batch invoicing5

- Enter and edit checks and expenses in a few clicks

- Streamline repetitive expenses, checks, and invoicing tasks

Batch transactions overview - 1:44

Customize access by role

Put the right information in the right hands

- Easily control who can and can’t see your sensitive data

- Assign work to particular users and increase your team’s productivity

- Create custom permissions for deposits, sales transactions, expense reports, and more

Custom User Permissions in QuickBooks Online Advanced - 1:55

Dedicated account team

VIP support with

- Contact a dedicated account team who will get to know you and your business and connect you to the right resources

- Conveniently call, email, or schedule an appointment with your dedicated account team whenever a support issue arises

- Resolve technical support issues quickly—top-tier QuickBooks experts are available 24/7 on the phone or via chat

Manage cash flow

Plan, save, and bank—all in one place

- Open a for business banking right inside QuickBooks.*

- Get paid online or in-person— at no extra cost, if eligible.*

- Earn , and save for goals and expenses with digital

- Forecast cash flow 30 and 90 days out to plan ahead and stay ahead.

A bank account reimagined for small businesses - 1:43

On-demand online training

Online QuickBooks training with

- Get free online training valued at $3,000 so you and your team can master new features

- Start and stop the training when it’s convenient, and watch as often as you like

- Get the most out of the features and capabilities in QuickBooks

QuickBooks Priority Circle Membership - 1:02

Online back-up and restore

Easily restore QuickBooks data

- Continuously and automatically back up your changes

- Restore a specific version of your company based on a chosen date and time

- View a log of version histories with a count of all changes made

A virtual expert to customize your setup

- Schedule an appointment with a Live Bookkeeper to tailor QuickBooks Online to your business.

- A certified bookkeeper will help set up your chart of accounts according to your needs.

- Get expert help connecting your bank accounts and automating the processes you perform most.

Premium Apps

Manage more of your business all in one place

- Integrate with best-in-class apps for tailored end-to-end premium solutions without the premium price tag

- Track data unique to your industry with apps like Bill.com, Salesforce, Hubspot, DocuSign, and more*

- Scale and customize easily on your time and budget

Automate workflows

Take the work out of workflows

- Save time and mitigate risk with automated workflows.

- Configure reminders and triggers based on your own rules.

- Automate reminders for improved cash flows and more.

How to use workflows - 2:13

Full-service payroll

All our plans include these full-service features:

- Fast unlimited payroll runs

- Calculate paychecks and taxes

- Automated tax and forms

Set up payroll once, and you’re done

- Run Auto Payroll1 for salaried employees on direct deposit

- Make changes and add additional compensation easily, like commission and bonuses

Health benefits for your team, provided by

Compare plans for affordable coverage

- Get instant quotes that fit your needs and budget

- Save time with a quick 3-step application

- Manage your benefits all in one place

Expert product support

Answers to your payroll product questions

- Payroll support experts available via

- Get step-by-step help, troubleshooting assistance, tips, and resources

HR support center, provided by

Answers for all your HR questions

- Ensure compliance with state and federal wage and overtime laws

- Learn best practices on hiring, performance, and termination

- Customize job descriptions, onboarding, and performance tools

Put less time between you and your deductions

Seamlessly transfer info to TurboTax

- Simplify tax time with built-in integration to TurboTax

- Avoid manual entry mistakes

- Track expenses in QuickBooks Self-Employed, accurately file with TurboTax

Fast direct deposit

- Keep employees and contractors happy with fast direct deposit

- Submit payroll up to 5 PM (PT) the day before payday

- Funds are withdrawn the day your employees get paid

Confidence that payroll setup is right

- Rest easy during payroll setup knowing an expert will review your work

- Avoid common pitfalls that often cause tax notices

- Switching from another provider? We’ll ensure data is transferred correctly

Expert setup review1

Confidence that payroll setup is right

- Rest easy during payroll setup knowing an expert will review your work

- Avoid common pitfalls that often cause tax notices

- Switching from another provider? We’ll ensure data is transferred correctly

Track time on the go

Easy mobile time and location tracking

- Workers can clock in or out anywhere,

- GPS tracking makes it easy to see who’s working where, at a glance

- Review, edit, and approve employee hours right inside QuickBooks

Restore company data

Easily restore QuickBooks data

- Continuously and automatically back up your changes

- Restore a specific version of your company based on a chosen date and time

- View a log of version histories with a count of all changes made

White glove customized setup

Professional payroll setup, done for you

- Get peace of mind knowing an expert will take care of payroll setup

- US-based specialists can answer any questions via

- Switching from another provider? We’ll ensure data is transferred correctly

24/7 expert product support

Prioritized help when you need it

- US-based payroll support experts available via

- Get step-by-step help, troubleshooting assistance, tips, and resources

- Call back support means you’ll get answers on your time—no waiting on hold

Track time and projects on the go

Manage projects and track time on the go

- Track project hours and labor expenses in real-time to eliminate surprises

- Geofencing alerts workers to clock in or out when entering or leaving the job site

- An activity feed lets team members add and view notes, photos, and project updates from anywhere

We’ll pay your IRS penalties

- Should you receive an IRS penalty, we’ll pay all penalty fees and interest up to $25,000/year

- Our Tax Resolution team will represent you and help resolve any payroll tax or filing issues with the IRS

Personal HR advisor

Talk 1:1 with HR advisors

- Consult with certified HR advisors by phone or online, powered by

- Receive professional guidance on critical HR issues

- Get helpful custom handbooks and policies created just for you

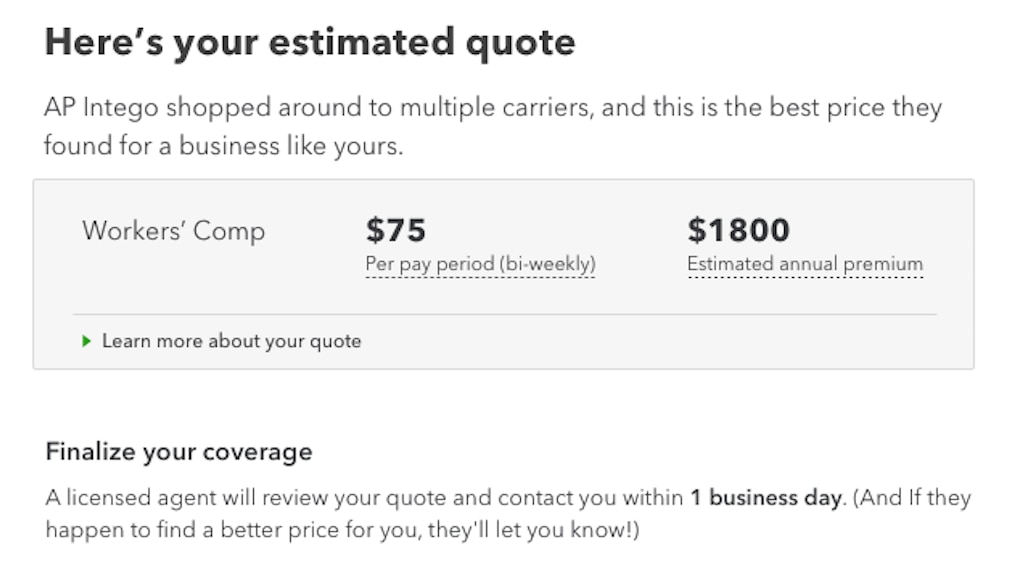

Conserve cash flow and simplify annual audits

- Get quotes inside QuickBooks—our broker AP Intego will compare plans and pricing for you. If you already have a policy, AP Intego will connect it to QuickBooks

- Keep more cash—pay as you go and stop paying one lump sum

- Premiums are automatically calculated so you don’t miss payments and reduce audit expenses